The Basics: What does a student participating in VITA do?

Participation in the program can be through ACCT 3265 (two credits), followed by ACCT 4265 (one credit), however volunteers are always more than welcome! If you have trouble enrolling or just want to volunteer, please fill out our Enrollment Request Form.

Students in VITA learn to prepare income tax returns... but it's so much more! We start in the spring semester with four weeks of training on Tuesday nights, from 6:00-9:00. Participants earn IRS certifications in Basic Individual and Nonresident Alien tax returns (looks great on a resume!). After training we start "Preparation Weeks," during which we prepare the tax returns of actual clients, using online software provided by the IRS. Each preparation week has three tax workshop days: Mondays, Tuesdays and Thursdays from 6:00-9:00 p.m. (the hours listed in StudentAdmin are the hours we have the room; students are only required to attend one three-hour session per week).

Clients sign up for appointments through our online system. In the first week or two, students are encouraged to work in teams, so don't worry, you won't be preparing your first few tax returns alone. Also, you will have LOTS of support: 1) several experienced students (returning for the 2nd, 3rd, or 4th time), usually holding Advanced IRS Certification, who are available to answer questions, and 2) your instructor, Leanne Adams, who is a licensed CPA and ten-year veteran of the VITA program. All returns go through a Quality Review process to ensure any issues or errors are ironed out before submitting each return.

Through client service, you'll learn professionalism and enhance your communication, social, technical, and problem-solving skills WAY above that of your non-VITA peers. For full details, see the VITA Course Syllabus. Please read on to hear what past VITA participants have to say about the program!

UConn's VITA program is a dynamic, enriching, infinitely worthwhile experience! Read what past participants have to say!

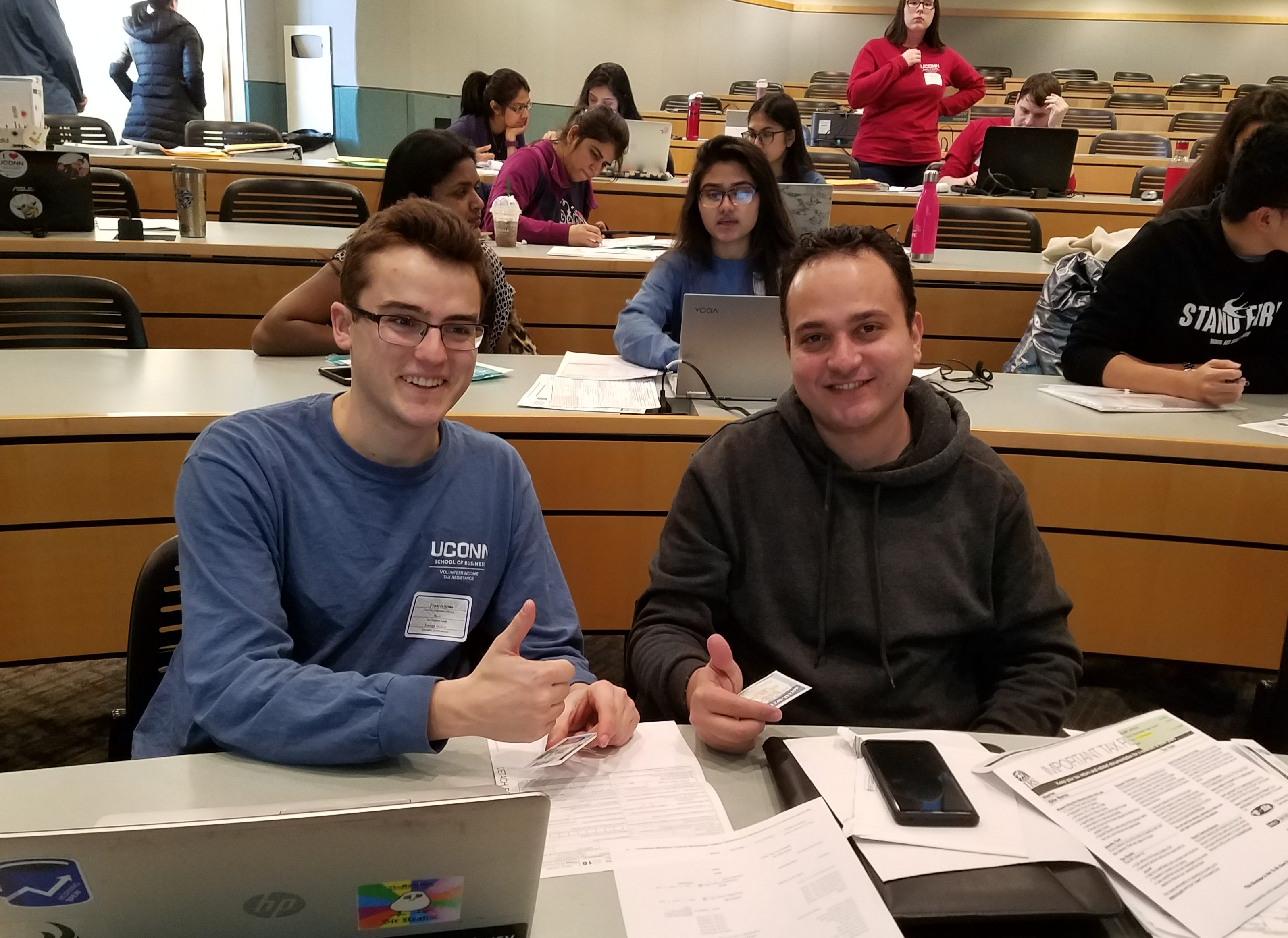

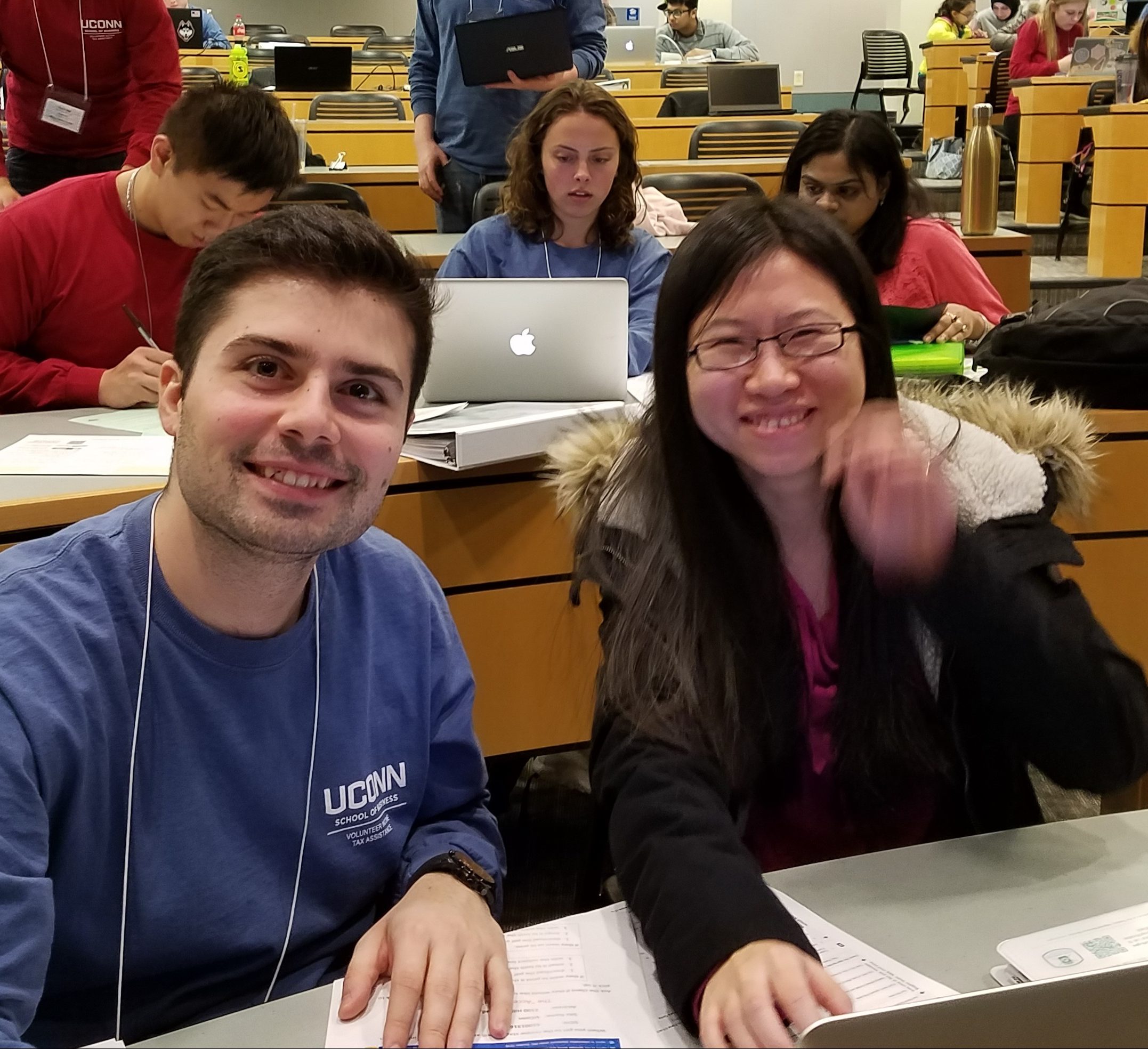

The VITA Environment

This is much more than just a textbook course; it is an entire society of dedicated students who want to give back and expand their learning.

I am so happy I did VITA. I felt like we became a community, where we were all willing to help one another out whenever possible. It gave me the chance to meet not only clients from different backgrounds, but many fellow classmates that I have never met before.

After my first week of preparing clients' tax returns, I no longer viewed VITA as a class I needed to pass, but more as a job, a responsibility, an obligation to my community. Each and every week, I would show up, ready to face whatever problems may arise among my tax returns for the night.

Through my VITA experience, I deeply felt and understood the meaning of teamwork. Our weekly tax return session is completed by the greeters sitting outside the classroom to check people in, preparers who input clients’ information based on different cases, reviewers who patiently answer every single question from preparers and carefully review tons of tax returns every night, and of course by professor Leanne’s efforts to always come up with ways to help us work more efficiently, share her own knowledge and experiences in tax return projects with us and to take care of this whole project. I felt very proud to be part of the VITA team as I truly experienced how a large project was divided into each segment and how a breakdown working structure needs to be achieved by every team member’s contribution.

One of the things that made VITA special was that we worked as a team to solve tax issues every night. Although we had our individual clients for each night, many students would become involved in other student’s tax returns when issues presented themselves. This was different from any other learning experience because issues were solved by constantly interacting with each other and we never had to feel like we were alone when solving a problem.

What I thought was impactful about VITA, more so than the actual completion of tax returns, is the bonds that are built and the perceptions that are broken. I now walk around campus without judging others because I have created relationships with huskies of an array of looks and backgrounds. I actually ran into one of my clients 2 weeks ago and he remembered it was my birthday; I was so surprised and happy that he remembered that.

Being a part of VITA here at UConn has truly been an unforgettable and extremely rewarding experience for me. The experience I have gained in relation to client services and professional etiquette are extremely valuable to have reinforced prior to the beginning of my future career in accounting. I found it enriching to think that these clients are relying on me to prepare their tax return, which I learned can be such a daunting experience for them. I also was able to reinforce my teamwork and conflict resolution skills through VITA, as not every tax return was as straightforward as the next. The reviewers were a great support system for us and helped us navigate through any situations we may have encountered. In the end , VITA has been one of the most enriching activities I have been apart of during my time at UConn and I am extremely proud of the production and success that we had as a collective group.

My favorite part of the VITA program was meeting students from outside the business school. As a commuter student, I spend all of my social time with students in the accounting department. I enjoyed becoming acquainted with people from outside the department. I particularly liked meeting the international students. It broadened my perspective on the challenges they face.

VITA brings together accounting students in an environment where we work together through challenging situations, just as if we were working in a real accounting firm. Besides bonding with each other, VITA allows us to connect with the greater UConn community.

One of my clients particularly stood out in this regard and I believe some of my classmates have had similar experiences. I prepared a tax return for a student from Nigeria. A couple days later, I saw him at the recreation center playing basketball and we had a 20-minute chat there about what we are both planning on doing with our careers. Since then, I have played basketball with him a handful of times and it is always great to see him there. Ultimately, the connections made personally between preparers, reviewers, and the clients are like the way that the UConn and this program can bond with the community.

My experiences in VITA were unlike any other course I had ever taken. Its unique "learning by doing" teaching strategy was initially what made me register, but its involvement in helping the community was what ultimately made it so enjoyable.

I have made many positive connections throughout my experience in VITA. I became friends with other VITA preparers and now study with them for other accounting classes we share. In addition, my favorite part of VITA were all of my clients that I served. Each and every one of them had a unique and interesting story that I loved learning about. It was such a great experience meeting so many foreign students and workers, hearing about their home countries and experiences in the U.S., and about their future career paths. These personal connections with my clients was the most beneficial and inspiring part of VITA.

I believe this program is extremely beneficial to the university and the community at large. From a student standpoint, we gain actual experience, credits towards our CPA exam, and are offered a fun volunteering opportunity. The program is beneficial to the community at large as we are helping people who feel they would not be able to do this without us. The university also benefits because the service we provided is something that people should be proud of. Especially since I don't know many times in my life when a PhD candidate will be asking me for help! Overall, I really enjoyed my time in VITA, it was definitely a great learning experience and I met many great people.

Words cannot describe how embarrassed I'm feeling writing this, but the entire notion of wanting to help the University and community at-large was likely one of the last reasons that I considered when deciding to participate in this program. Indeed, when Leanne first came to my tax class in the Fall of 2017 to introduce us to the VITA program, nothing about this program really caught my attention. After all, when it came to service learning, there were other things on campus that I could have potentially participated in if that is really something that I wanted to do. But that was until she started talking about how students participating in VITA gain IRS certification that they can then put on their resume. It was at that exact moment that I knew I wanted to enroll in VITA. After all, as a junior heading into his final year of college, improving my resume as much as possible to increase my chances of being recruited is what all I really thought and cared about at that moment. Yes, from the very beginning, I was never really in it for the community, I was in it for myself.

But as I walked out of BUSN 106 for one last time on April 8th in my VITA shirt, the thought that I had finally achieved a certification to put on my resume never really crossed my mind, not even once. Somewhere along the course of this semester which I would describe as being nothing short of an extraordinary experience, I had stopped solely concentrating on the benefits of VITA to me. What I had instead started focusing on about this program were the benefits that it was providing to the University and community at-large. And how could I not? After all, when you work with your clients sometimes for hours on end filled with little moments of awkward silence and they still leave the room at the end of what would be an exhausting night with a warm smile and a 'thank you', you just cannot help but see the bigger picture in play. And for me, that has been without a doubt the biggest positive takeaway from this entire program.

Participating in VITA has taught me a whole lot about social responsibility as opposed to self-interest which has historically been the driving force behind a lot of the decision that I have made in the past. Beyond just learning about social responsibly through service learning, VITA has also exposed me to a ton of diversity and multiculturalism that I otherwise wouldn't have experienced to the extent that I did in VITA. I worked with clients from India, China, Ukraine, Turkey and England. And while majority of the time was spent explaining the various steps involved in preparing their tax returns, I did get to spend some time talking to them about their move to the U.S. and how does it compare to their native country while sharing my own experience of moving to the U.S. from India. Such exchanges, while irrelevant to the actual process of preparing returns, were really meaningful to me to the extent that they first and foremost served as a nice ice-breaker and secondly provided me with valuable experience in dealing with a diverse set of clients which I would without a doubt encounter in my professional career in the future.

The benefits of this service to the University and community is obvious. It's not only a way to give back to our community and those serving our school - like graduate students, TAs, etc. - but it's such a humbling experience. I genuinely believe there's a lesson that every single person has learned from participating in VITA. And I believe there are so many students at this business school who don't see how life is like for people of other nationalities, cultures, and backgrounds. It's honestly a shock to see how much I've actually learned about the clients I've sat down with, and I don't think the students at our business school are often exposed to interacting with people like our clients. I believe this program has broadened the horizons of many of the accounting students, and that many of them have developed a greater respect for differences in people. I doubt that many of the VITA preparers/reviewers would have otherwise interacted to this extent with people like our clients.

VITA is not just for Accounting majors!

I would encourage anyone who even is not a business major, to take this class. It is important to learn these skills taught throughout this class, not even just about income taxes but about being on a team and working towards a common goal.

The benefits to participating in UConn's Volunteer Income Tax Assistance (VITA) program are legion! Take it from your peers:

Personal and Professional Growth

The VITA program at the University of Connecticut has been one of the most beneficial courses that I have taken during my time in college.

When I signed up for VITA I had no intention of gaining any benefits either professionally or personally from the class, it was simply the last 2 credits I needed to graduate. Tax was my least favorite class at UConn and I had no idea what kind of tax knowledge was required for this class so I was quite nervous. After talking with my friend, [a VITA Site Coordinator], I was assured that I could be successful in the class and I should embrace it with an open mind. I have to thank her for telling me that because VITA has taught me more about myself and has allowed me to grow more than any other class. I saw personal and professional weaknesses when thrown into the VITA environment but this environment also allowed me to progress and develop those aspects that will be used in my career and everyday life.

Doing VITA this year has greatly aided me in my personal and professional growth. Some of the benefits of this experience include becoming much better at asking questions, better at communicating with others in a professional setting, and most amazingly, I have more confidence in myself. VITA has helped me 'come out of my shell,' as I tend to be quite shy. By the last night of VITA, I was conversing with my client with ease, and asking questions, without feeling stupid or uncertain for doing so.

The biggest benefit I gained from participating in VITA is learning how to work on a team. VITA has been different from any other group project I have had because of how large the team is in addition to the types of interactions we have and the work we are doing. Being a part of the VITA team meant that it was crucial for you to lean on others and for others to lean on you.

Helping the community is intended to help those you are assisting, however, I found that I received more out of this program than they probably did. Each night my heart was so full of joy from the stories I learned of clients' travels or what they are involved in at school. I was amazed at what one student was researching in psychology. She was even younger than me and already learning about brain chemistry and depression in a scientific way.

Overall, after looking back on my experience with VITA, I am filled with so many memories of personal growth and reality checks. I am grateful to this program for allowing to me to experience real-world situations, see the impact that I have on other people, and engage in many enjoyable conversations with my clients.

Out of all of the classes I have taken this semester, I think that I learned the most from VITA because I really enjoy hands-on learning and getting to know my clients. This was my first time ever working with real clients and I can honestly say that this class has taught me valuable skills that will carry through in my career. This is something that I think is hard for a class to accomplish but VITA has really made me excited to be an accounting major. It also showed me how to properly answer clients' questions and to behave in a professional manner. When you are in a classroom just learning from a lecture you really cannot learn how to speak with other individuals. This is something you only learn by actually doing, which is why I am truly grateful for the opportunity to take VITA.

Beyond the benefits to the clients, I think this is one of the most applicable courses I have ever taken, in terms of knowledge acquired and its application in the real world. Sure, I’m taking upper-level engineering courses and math courses, but I’m not even going to use half of that stuff in the future. I am now leaving this semester with a valuable tool under my belt that I can take with me and use for literally the rest of my life, and I think that’s really awesome.

Giving Back to Your Community

This year was the first year I was able to use my accounting skills to create a real impact. I have had internships before where I was in charge of keeping up with ledgers and manipulating excel workbooks but I never felt like I was making an impact in other peoples' lives. VITA provided me with this new feeling of accomplishment with respect to me field of study. I think it is great exposure for any accounting major to come to the realization that their work goes beyond crunching senseless numbers. I had a wonderful time this past semester and have established a greater respect for what my profession entails. From what I have heard, no other business major has something like VITA where students would be able to apply their knowledge in the real world and create notable impact. For that I am grateful and very satisfied with my decision to have joined VITA in the first place.

One of the clients I actually served towards the end of VITA actually gave me a hug, and it was in that moment that I realized all of the time I've given this semester has truly made an impact on people. This was a challenging but incredibly rewarding experience and I'm glad to have had it.

I've learned that it's a beautiful thing to work with others for a good cause. It was a joy to bring smiles to the faces of our clients who were all very appreciative of our work. That alone, made it all so worth it.

Lastly, I'd just like to say how much of a positive experience I think VITA has on everyone involved. For us students it really is helpful to get a practical application of some of the things we learn in our

accounting classes. It's also nice for the clients that we are serving too. They obviously get their taxes done, but it's so much more than that. It provides that sense of the UConn community just helping each other out. I can't really think of another program that provides so much for everyone involved in it, and I'm happy that I was able to take part in this experience.

A lot of times when I went to VITA I was very tired and did not really feel like working, but after seeing how happy many of my clients were after I did their returns I felt really good about myself.

Also, this class was very motivating for me. Usually when I walk into a classroom, my goal from day one is to read the syllabus and figure out exactly what grades I need to get an 'A'. When I walked into VITA, the goal was not to get an 'A', but rather to help people. Typically, halfway through the semester it becomes more and more difficult to go to class because all I am trying to accomplish is getting that 'A'. In VITA, each week it did not feel like a chore to go to class because I felt I could help someone with their own life.

Developing Valuable Communication Skills

This experience allowed me to communicate with people from all different countries. One of the first tax returns that I did, the guy was actually a refugee and his story was extremely interesting. It was just fascinating to see how different each one of us really are.

This program has greatly helped my communication skills. Communication had never been something I thought I struggled with but after doing my first view returns I found it much harder to communicate with complete strangers in a professional setting. After my first few returns I felt as if my returns were going smoother in terms of communication. I already have enjoyed the benefits of these improved communication skills because I felt as if I was less nervous during my job interviews after doing so many returns.

Real Life Accounting Experience

When I signed up for VITA I had no intention of gaining any benefits either professionally or personally from the class, it was simply the last 2 credits I needed to graduate. Tax was my least favorite class at UConn and I had no idea what kind of tax knowledge was required for this class so I was quite nervous. After talking with my friend, [a VITA Site Coordinator], I was assured that I could be successful in the class and I should embrace it with an open mind. I have to thank her for telling me that because VITA has taught me more about myself and has allowed me to grow more than any other class. I saw personal and professional weaknesses when thrown into the VITA environment but this environment also allowed me to progress and develop those aspects that will be used in my career and everyday life.

Doing VITA this year has greatly aided me in my pers

Most classes only give you knowledge and background information, but never give you the experience of how you will apply it in the real world. This class is excellent in that matter because you have actual customer interface, and you are taking what you learned from federal income tax and the training we did in the beginning of the course, and applying it to situations with the clients. For this reason, I feel this class is one of the most beneficial classes I will ever take as an accounting student here, and I truly mean this.

I think that it is amazing to think that in January I had no idea what a tax return actually was, and today I am able to prepare them for real clients on my own. I think that this is the greatest benefit of participating in VITA. It was my first exposure to real-life accounting, which was awesome!

Being a part of VITA was really one of the most beneficial experiences I've had while being an accounting major. I feel as though it was a fourth internship, as I had as much hands-on experience and exposure to a type of career (tax preparation) from VITA as I did through the companies I interned with each summer.

Not only the fact that students can learn how to prepare tax returns, it also taught us to be reliable, professional and customer service orientated. These are the skills that we won't be able to learn inside a classroom taking notes and preparing for exams. In order to learn these skills, it must be gained through hands on experience, which VITA gave me this opportunity.

Vita is more than a two-credit course. I think it is a precious experience that puts you in the field and pushes you to act like a real professional.

VITA mimics the assistant/partner/manager relationship as we students interact with the faculty site coordinator and reviewers, the client/service provider relationship as well as the unusual circumstances that are often seen in accounting firms and the industry.

Being able to have credits towards my graduation while having a hands on experience with clients was incredible. I think more classes of this nature should exist as students can only learn so much in the classroom and applying it to the real world is never really discussed in class. I think this was a great step for me as I was able to learn more about the real world and being able to have real conversations with clients from the UConn community.

onal and professional growth. Some of the benefits of this experience include becoming much better at asking questions, better at communicating with others in a professional setting, and most amazingly, I have more confidence in myself. VITA has helped me 'come out of my shell,' as I tend to be quite shy. By the last night of VITA, I was conversing with my client with ease, and asking questions, without feeling stupid or uncertain for doing so.

Helping the community is intended to help those you are assisting , however, I found that I received more out of this program than they probably did. Each night my heart was so full of joy from the stories I learned of client's travels or what they are involved in at school. I was amazed at what one student was researching in psychology. She was even younger than me and already learning about brain chemistry and depression in a scientific way.

Overall, after looking back on my experience with VITA, I am filled with so many memories of personal growth and reality checks. I am grateful to this program for allowing to me to experience real-world situations, see the impact that I have on other people, and engage in many enjoyable conversations with my clients.

Out of all of my classes I have taken this semester, I think that I learned the most from VITA because I really enjoy hands on learning and getting to know my clients. This was my first time ever working with real clients and I can honestly say that this class has taught me valuable skills that will carry through in my career. This is something that I think is hard for a class to accomplish but VITA has really made me excited to be an accounting major. It also showed me how to properly answer client's questions and to behave in a professional manner. When you are in a classroom just leaning from a lecture you really cannot learn how to speak with other individuals. This is something you only learn by actually doing, which is why I am truly grateful for the opportunity to take VITA.

The VITA program at the University of Connecticut has been one of the most beneficial courses that I have taken during my time in college and I am pleased to have completed 10 returns over the course of the eight weeks. As a preparer, these Tuesday nights transitioned from being a nerve-wracking experience to something I looked forward to each week.

Impressing Potential Employers!

Employers appreciate that, as accounting students, we’ve seized the initiative to involve ourselves in our community and sought the opportunity to develop our accounting/professional skills outside of the classroom. It shows our commitment to the profession, and it also tells employers that we are interested in learning. It’s a great talking point for interviews, and an experience that can give a candidate a significant leg up.

VITA has given me a leg up on my competitiveness in the job market, made clear by the internship interviewers who were very impressed by my participation in this dynamic program. The real-life scenarios I recounted to the recruiters showcased my transferable soft and hard skills to the workforce, and they were impressed with my tax experience at an age where most accounting work is done in the classroom.

Throughout my leadership program or internship interviews, my interviewers were always interested in, and wanted to hear more about, my experiences in VITA, which helped set me apart from other candidates.

VITA really is an incredible opportunity for students to participate in. It is hands-on community service that allows us to apply what we learn in the classroom to real life situations, as well as learn about an entire section of tax law that is not included anywhere else in our curriculum. I talked about VITA at lunch with the managing partner of the Grant Thornton Stamford office and he was so impressed with how much I knew about foreign tax and how familiar I was getting with it. It is definitely a talking point in interviews and beyond and does stand out to employers.

It’s important to remember that while grades are important, they are not the only thing that are important when interviewing for an internship or a job. Employers give just as much consideration to what candidates have accomplished outsides of academics as they do to a student’s grade. Thus, every student has an incentive to participate in and acquire new experiences that will make him a stronger candidate for an internship or a full-time position. For those majoring in Accounting, VITA is just the kind of experience that employers want. Not only is it in a field related to accounting, but the social aspect of the program is especially attractive to firms who want their employees to continually participate in community service outside of work.

Finally, it was really beneficial for me to get some experience in the field of accounting that I was then able to put on my resume and talk to potential employers about. This came in handy especially when I was interviewing for a PwC leadership position and I had a second-round interview. The partner that was interviewing me was very interested in the VITA program that was on my resume and we talked about it for 10 minutes during the 30-minute interview. I really credit my participation in VITA and the knowledge that I gained from VITA with the reason I was accepted into this leadership program.

Another benefit I received from this experience was the respect I earned from my friends and family. Some of them could not believe 1 was filing people's taxes for them because much like me, they thought it was really difficult. In addition, another benefit 1 got was that it satisfied my volunteer hours and it looked great on my resume.

I think I can speak on behalf of both myself and fellow classmates, VITA has provided me with a strong foundation of hard and soft skills that will only help propel my career. I am proud to say that I have recently accepted an offer for a State Taxes and Audit Management internship with [a sustainable energy company with over 6,500 employees $31B in assets and operations in 24 states] this upcoming summer. I don't think I would have been given this opportunity if it weren't for the VITA program.

Looking back I see that VITA has exceeded my expectations. It did this by letting me give back to the community, which I had never had the time or opportunity to do, and it gave me experience

working on tax returns. Even if I had taken a tax class there was still a lot I didn't understand about tax returns. At VITA I was quickly taught how and what I needed to do. On top of all this, VITA also gave me something to talk about in interviews for jobs. I cannot stress how many times I was asked a question and I was able to point to one of my experiences at VITA.

Meet new people with incredible backgrounds!

What I’ve found most enjoyable about working with international students is that I get to learn about their home countries, cultures, and what they are studying. It’s always interesting to hear about their experiences and backgrounds, and it gives me a deeper appreciation for different perspectives. These conversations have made my VITA experience even more rewarding and helped me develop a better understanding of diverse cultures.

One of my favorite parts of VITA was meeting students from outside the business school. Connecting with students and teachers with different backgrounds gives us a broader perspective of our community. I enjoyed talking to international students and hearing about their experiences.

I'm scared! What if I make a mistake on someone's tax return?

We have an extensive review process! Furthermore, mistakes are part of the process!

I have made mistakes and hiccups along the way but one of my favorite aspects is how everyone worked together liked a team and just wanted to help you.

The first three weeks of taking on clients I would describe myself as nervous. Looking back, the nerves stemmed from the responsibility of someone else's finances. I worried that I'd genuinely mess up or

negatively impact someone's day. After only the first week of taking on clients individually, this fear subsided. I realized that I actually knew what I was doing and shouldn't second guess every input I placed into Taxslayer Pro. I also came to realize that the reviewers wouldn't be mad if I forgot something every once in a while. The reviewing process mirrored how accounting in the workplace would work. Individuals in all industries are not alone; they are constantly monitored and have parameters in place so mistakes are minimized, as did the VITA program.

As for problems I encountered during VITA I never felt that there was anything too difficult to handle. If there was a scenario that I didn't know how to do something, help was never too far away.

Problems are a natural thing to happen since we are all new and most of us have not done tax returns before, however, it is how you handle them that shows a client they are in good hands.

VITA has all the help I need during the tax return preparation. For example, we have site coordinators, viewers and instructors there to answer our questions and fix our mistakes, we have screeners and greeters help us to get all the documents and information we need. This environment gives us the courage to make mistakes and learn from it.

From VITA, I have developed my communication skills by learning how to ask questions when I don’t understand something even though I may feel uncomfortable doing it. Professor Adams, the reviewers and even the other preparers are very helpful when I have needed it and I have felt more comfortable asking questions and have learned a lot just from doing that.

I learned that when I encounter a problem, I should take it to a [reviewer] for clarification after trying to solve it on my own. Learning how and when to ask questions in VITA has better prepared me for this than any normal classroom setting ever could. This class allowed me to learn in a different way than most classes and one of the main differences was that VITA allowed me to make mistakes and learn from them in a very different environment.

The best part about making some of these mistakes is that once you make that mistake once, you won't make it again. The service learning aspect of VITA is so helpful to accounting majors because it is so hands on and is entirely different than the fake tax returns you do for hypothetical people in the introductory tax class. Having to figure out which forms to do and which treaties apply for the given client is like working on a puzzle and it was so rewarding even when mistakes were made because you learn so quickly from them and I am thankful for this experience.

I [had] only completed one tax class before VITA and was nervous that I would mess up horribly and get in trouble. However, over the course of this tax season I completed roughly 15 tax returns for other people and looking back now it was such a rewarding experience and I would do it again in a heartbeat. I found that once you got into a rhythm of it that doing these tax returns was a piece of cake.

Furthermore, [VITA] promotes getting into the habit of being able to ask questions. I do not think I have ever asked as many questions in one class as I did in VITA. Even when I felt bothersome, I knew that the benefit of getting the correct answer was more important than relying on an instinct that may or may not have been right.

I was taught to look up the solution on my own but encouraged to ask questions to our reviewers to confirm or look for additional help and guidance from them.

I was really nervous starting off this tax season with VITA. After having a stressful experience with my federal income tax class, I didn't know what to expect. I quickly learned that the experience I gained by participating in the preparation of returns would change my outlook on taxes and the process of filling a return. Originally, I had the same perception as everyone about filing taxes, I thought it was a complicated process. My opinion quickly changed after the first class of actually preparing returns. I immediately felt comfortable and confident when dealing with clients and their questions. If the knowledge gained from this experience wasn't enough, seeing how the clients were appreciative was. I was able to go home on Tuesdays feeling satisfied that I could relieve someone's stress by doing their taxes.

Another benefit of VITA is that I learned to ask for help when I need it. I understood that there is going to be times when I don't know something and I should just ask for help from someone so that I do not waste time. I also referred to the training materials when I had questions which were helpful. In the future, I will continue to ask for help when I need it and will offer my help to other people.

The very first time I was placed one on one with a client there were many questions that the client would throw at me that I didn't know the answer to at first. At first, I would panic and flip through my notes or the manual in front of the client in search of the answers and be too embarrassed to say "I don't know." Over time I was able to learn that it was okay to "I don't know," but to make sure that I used the numerous resources around me to find the answer for the client. It was tough to learn to be okay with not knowing all the answers. Note from Leanne: you actually appear MORE PROFESSIONAL when you admit your limitations and seek out the correct answer!

[When a] problem occurs [it] is a good thing, it is a chance to realize what I do not know!

It did get confusing with the treaties... but whenever I struggled the client understood and the reviewers came to my rescue! They were extremely proficient in explaining to me how it worked.

When I first joined VITA, I had no idea what to really expect. I was not confident in my ability to perform tax returns, especially in real life. This was partially due to doing so poorly in a tax class last semester. That being said, by the end of the training I was much more comfortable with being able to take care of a client with a partner to catch any potential mistakes I made. Within a few VITA sessions, I was confident that I could take care of clients by myself and by the end of the tax season, I actually reviewed a few returns and answered people's questions around the room.

I won't [say] that I didn't make any mistakes. However, I will say that I don't think I would have dealt with them differently. The reason for that is because it was through those mistakes that I learned what I needed to do. At the start I accidentally missed the 8843 form and I never missed it again because I remembered my mistake. I learned more from those mistakes that showed me what I was doing wrong than I did from sitting in a classroom.

What are the clients like?

95% of our clients are foreign students and scholars who have never encountered anything like the U.S. Tax System. They are naturally confused and afraid of the daunting task that is their income tax return. When they arrive, and are treated with kindness and professionalism, they are genuinely grateful for the service we provide. Read some nice stories, below!

Every client that I had was so incredibly thankful; we made something confusing and daunting seem like an easy and straightforward process.

The benefits that this service provides as a whole is astounding. I cannot even begin to count all the times that I have been thanked for just simply checking over client documentations or helping them fill out their intake form. The people that come through are very thankful that this service does exist and is located in the area.

One of my clients was telling me about the research he does in his Biomedical engineering PhD program. He worked with cancer cells to isolate them and study the reactions they have with different stimuli. I remember thinking, "Wow! How cool would it be if this man was to cure cancer and I'm the one who filled out his tax return to make sure he can continue that research." In that moment I felt proud, not just of filling out a tax return, but for being able to provide a service to a client who needed it.

Preparing tax returns for clients was such an amazing experience I never had before. I had to meet people for the first time and make them feel welcomed to be here while also keeping a professional persona. It was an easy task and a lot of fun to get to know the person you are preparing their taxes for. My first client was from Iran and we got into a conversation in how I was part Iranian and he was teaching me about the culture. He was a graduate student and recommended me joining the Iranian society at UCONN and gave me his number if I had any questions. Then there was this lady named Caroline and she was from Austria. She majored in German Studies and was travelling around the world teaching German in different colleges of those countries. It was interesting to hear a person's story, where they are from and what they are doing, whether it is work, studying or finding their way in life.

It never ceases to amaze me how interested our clients are in learning how their taxes are being prepared. They ask so many questions and have such a genuine interest in learning how and why things are done a certain way, because all of them are so excited to be able to prepare their own taxes in the future.

I found it surprising about the client's knowledge and respect of the tax laws and the IRS. Some clients had no idea how the tax laws worked. These were usually international students who have never filed their taxes before. These clients were very interested in understanding what I was doing. They were asking me questions about why I enter certain information in certain spaces and how the software worked. I enjoyed working with these clients because they had an interest in our tax laws. Other clients who have filed their taxes in previous years had quite a good understanding of our tax laws and the IRS. One of the clients I had was going through all of the information I put in to see if it was in the right place and to see if her refund amount was accurate. When this client was unsure of what I was doing, she would ask me to explain it to her. It made me happy to be able to share my knowledge about our tax laws.

When I found out that we would be physically working with the clients, that made me very nervous because I didn't feel like I was knowledgeable enough regarding how to actually use the tax software and the various components of the income tax forms. Additionally, I had never worked with an actual client and I thought that it would be awkward to fill out someone's return without talking to them during the process. I decided that the best way (initially) to avoid the awkward silence was to explain all of the values that I was inputting into the tax software and I also tried to explain how the various values were affecting their ultimate tax due or refund. Not only did this fill in the awkward silence, it allowed me to better understand the tax return and communicate my knowledge and also allowed the client to gain more insight into how to calculate and do their taxes because more often than not my clients were very confused by income tax and how to file their taxes. This experience also allowed me to further develop my communication and networking skills. At the beginning of VITA, I mainly clung to my script of explaining the values I was inputting, but as the weeks went by I would initiate small talk with my clients and I actually learned a lot about them.

Oh, the places you will go! Why would I want to return as a Reviewer or Site Coordinator?

Because being a mentor and leader is super rewarding and looks even BETTER on your resume! Here’s what former Reviewers and Site Coordinators have to say!

I learned a lot through my time as a preparer, but I gained even more as a reviewer. The biggest difference to me was having to jump into a return and familiarize myself with the case in just a few minutes versus handling the return from start to finish. This sharpened my analytical skills and helped me focus on the key aspects of each return.

Being a reviewer gave me experience with management skills that will be useful as I progress through my career. I haven’t had many opportunities to practice my managerial abilities, especially within the context of accounting. As a reviewer, preparers looked up to me to set the tone, answer difficult questions, and guide them through the process. Having this experience helped me become more confident in managing others and will be a critical skill as I move forward in the profession.

Being a Reviewer pushes you into being someone who displays confidence and can reassure both the client and the preparer. Being a VITA Reviewer has helped increase my social self-confidence.

Additionally, being a Reviewer offers greater opportunity to work with and learn from others. While walking around the classroom, it is apparent who are the people that need some extra attention whether they are sitting alone, or [based on] the look on their faces. Being a Reviewer felt like a TA role as I was able to walk around and interact with all of the students to make sure everyone was okay. This experience increased my empathy and sensitivity to others and their needs.

You had me at hello! However, I’m having trouble enrolling. Can you help?

This course meets only on Tuesday nights in the first few weeks for training, then students sign up for one night per week to serve clients. Thus, students only have to attend one night per week, but StudentAdmin reflects all of the times we have rooms reserved (M/Tu/Th nights and Fri mornings). This often creates an enrollment conflict for students trying to enroll in a course that meets during one of the times we have a room. Please fill out our VITA Enrollment Request Form and we will get back to you as soon as possible!