PLEASE NOTE: you may have one Form 1042-S, or you may have two! Please read on to determine if one or both apply to you.

1042-S for Wages (code 20 in box 1)

If you work at UConn, there are two ways to determine if you should have a 1042-S for wages, as follows.

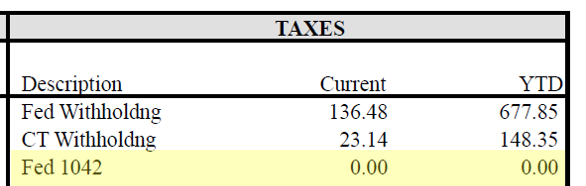

- Look at one of your 2021 pay stubs*. Under the taxes area, if you are getting a 1042-S will see "Fed 1042" as shown to the right.

- Look at your 2021 W-2. If the amount in box 1, "Wages, tips, other compensation" is less than the amount in box 16, "State wages, tips, etc." then you definitely have a 1042-S for wages.

These forms are generally mailed the first week of March, by the State of Connecticut, to your home address of record in Core-CT.

* To view your paystub, log into Core-CT at ess.uconn.edu and select "View Paycheck Information" under "Payroll" in the middle of the next screen.

1042-S for Scholarship and/or Fellowship Income (code 16 in box 1)

If you received a taxable scholarship, fellowship, or grant, you will be receiving a 1042-S with code 16 in box 1.

If your residency for tax purposes is a country that has a treaty with the U.S. to exclude this type of income, it will be reported on this form and not taxed on your federal tax return. This income is still taxable by the state of Connecticut.

If your residency for tax purposes is a country that does not have a treaty with the U.S. to exclude this type of income, the University will withhold taxes for this income and you will see a charge labeled “Non-Resident Alien Tax” on your fee bill*. That withholding will also be reported, along with your scholarship income, on Form 1042-S.

This document lists, on page 7, countries who have treaty benefits for scholarship income.

These 1042-S forms are generated here at UConn. If you are getting this form, you will have received an email at the end of January from the Tax & Compliance Office. These forms were mailed on February 5, 2025, via the United States Post Office to your address on record at the Tax & Compliance office. If you have moved within the last year, you must make sure you have updated your address with Tax & Compliance. Their system is NOT connected to StudentAdmin or Core-CT therefore they will not have your current address unless you tell them directly. You can email your current address to taxcompliance@uconn.edu. As with the 1042-S form for wages, please do not apply for our Virtual VITA Service until you have received this form!

* you can find your fee bill in your Student Center on StudentAdmin. Under "My Account" click on "View Fee Bill." For more detail, see this website.